Content

Synchronization of payments for bills and invoices. These journals includebalance changesin inventory accounts, Work in progress , Cost of Goods Sold , etc. Ifbalances are synchronized, payments are synchronized two-way. At present Xero does not support the importing of inventory values for items via API. These journals include balance changes in inventory accounts, Work in progress , Cost of Goods Sold , etc.

Fields in Xero table display the list of available Xero fields that can be entered or updated. The goal is to map DataSet headers to https://bookkeeping-reviews.com/ the Xero object fields. G-Accon provides field data types and discrete values. Column mapping contains the headers of your DataSet.

Supercharge your Xero

We also sell online tickets for our events and occasionally we receive a donation – which all comes through paypal, but as one total figure . This gets sent to an “Online Tickets” account on the balance sheet. JournalLine_TrackingCategory2_OptionName# String False The option of a tracking category. JournalLine_TrackingCategory2_OptionId# String False The Id of a tracking category.

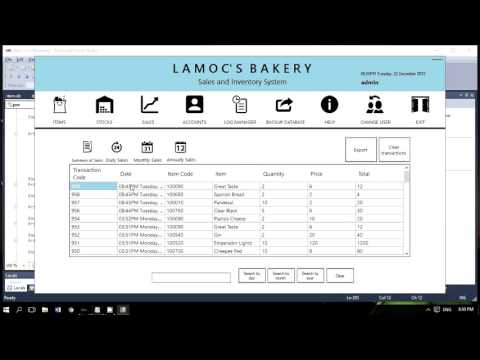

If you want to have your milk income align up with the kgMS in your milk trading statement then we’d recommend you use the Account journals tool available in Figured to do that. All orders in Veeqo are exported into Xero, when this happens we create a journal within Xero for the COGS . This journal decreases your stock on hand account and increases cost of goods sold COGS account. Two journal entries show 1) an increase in the baking supplies account and 2) an equivalent decrease in the cash account . Use this function to create a manual journal record.

MRPeasy

Synchronization of balances, by making a journal in Xero. After an Invoice is approved in Xero, it is not possible to update it via the integration from MRPeasy any longer. After a Bill / Purchase order has been approved in Xero, it is not possible to update it via the integration from MRPeasy any longer. If a part number is longer than 30 characters, then the item is not transferred to Xero as a product. The part number is combined with the description into the description field. Make sure that the inventorycounts and balances are correct in MRPeasy, and the balances match with Xero.

In this case, you can manage your manual journals through your accounting system. The ManualJournals table allows you to SELECT, INSERT, and UPDATE manual journals journal lines for a Xero organization. The Id column is generated by the cmdlet; it combines the index of the line item with the unique, Xero-generated ManualJournalId. For small businesses, accounting software is a must-have for managing financial data efficiently. In this blog post, we will delve into the details…

Cmdlets for Xero

This integration creates a workflow with a Pipedrive trigger and Xero Accounting action. When you configure and deploy the workflow, it will run on Pipedream’s servers 24×7 for free. Raul @raul_predescu If you’re a dev and not using @pipedream, you’re missing out. Manual Journals can be added to DEAR operations such as sale, purchase, inventory, etc. Each operation has a Manual Journals tab where they can be added. Please create a new post if you need help or have a question about this topic.

Please check the status and type of the invoice. Please check the list of events and transactionsto understand when certain transactions are recorded. If balances are synchronized, for all existing products in Xero, you must verify that the Purchases account matches the integration configuration. If balances are not synchronized,savethe mapping of accounts, and the integration is set up!

If not selected, these can be sent manually only. This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice. There are 4 the most common errors made by our clients when they import Manual Journals into Xero.

Considerations when syncing balances when the use of planned goods is allowed. If you are utilising multi-farm you will also choose which farm this is happening on. My milk production is showing correctly Manual Journals In Xero for 2021, however my milk income on the right hand side is showing one month out. Go to the Manual journals page in the left side menu. Manual journals give you full control of your books.