Content

This includes salaries paid to corporate officers who are employees of the corporation . A Form UC-86 that is filed after the March 1 deadline must be submitted no later than December 31 of the year following the year of the transfer. Upon approval, the successor’s reserve will be combined with the predecessor’s https://kelleysbookkeeping.com/ reserve balance to determine the successor’s experience rate. A Form UC-86 that is received after December 31 of the year following the year of the transfer will be returned unprocessed. Acting for the employer, the agent may submit all required reports and contributions under their own signature.

What are the responsibilities of employers regarding unemployment in Ohio?

Employers are responsible for: Reporting their unemployment tax liability as soon as there are one or more employees in covered employment. This may be done at thesource.jfs.ohio.gov or by completing the JFS 20100, "Report to Determine Liability", and mailing it to P.O. Box 182404, Columbus, Ohio 43218-2404.

• File contribution and quarterly wage reports timely, together with contributions due. • Wages paid to the two employees by this corporation during the period of the election cannot be used to establish a claim for unemployment benefits. Access your online unemployment insurance account to view and manage your employer information. Federal and state laws require employers to provide information about Employer Liability For Unemployment Taxes all new or rehired workers to the Employer New Hire Reporting Operations Center in the Texas Office of the Attorney General within 20 days of the effective hire date. The FUTA tax is imposed at a single flat rate on the first $7,000 of wages that you pay each employee. Once an employee’s wages for the calendar year exceed $7,000, you have no further FUTA liability for that employee for the year.

Unemployment Tax Liability Terms

A web-based system that allows the Department of Labor and employers to communicate when a new claim is filed. Each Professional Employer Organization which co-employs one or more individuals with a client in Tennessee must complete and file the Report to Determine Status, Application for Employer Number (LB-0441). An employer who has acquired all or part of the business of another employer who was already liable. The Employer Account Number will be mailed to the address provided on the form. For inquiries about the status of your Employer Account Number, please email Deaf, hard-of-hearing or speech-impaired customers may contact TWC through the relay service provider of their choice.

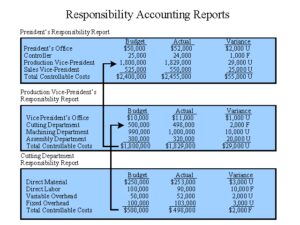

Tax rates are assigned to all subject employers using the same experience rating formula. The base rate in effect for a given year is determined by the solvency of the Unemployment Insurance Trust Fund as shown above. In November of each year, active employers will be mailed an Unemployment Tax Rate Assignment , which shows the calculation of the tax rate for the succeeding calendar year. Experience rating accounts are maintained for rating purposes only.

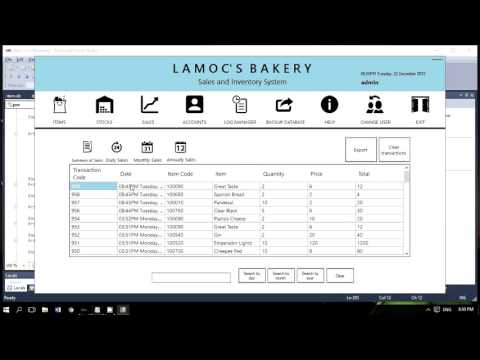

Filing wage reports and paying unemployment taxes

Because tax rates are recalculated only on an annual basis, most employers pay unemployment insurance taxes at the new employer rate for at least two years before getting an experience rating. Without exception the tax rate of an employer that has had three calendar years of benefit liability will be based on experience during the last three years. After three years, the rate is based on a rolling three year experience. Existing Employing Unit Acquired Business- When an existing business entity acquires assets, employees, business, organization, or trade from another employer, the existing business entity is classified as a successor employer.

To make an electronic payment, you must transmit your payment by 1 p.m., Central Time. The money an unemployed person gets from unemployment insurance is funded by the payroll taxes your company pays to the government. Unemployment insurance is managed by both federal and state governments. Each state has its own unemployment insurance program, which the federal government oversees. Because each state has its own rules for administering unemployment benefits, it’s important to know what they are for each of your company locations. An account for each employer covered by the Iowa Employment Security law is maintained by the Unemployment Insurance Division.

Unemployment Insurance Tax Topic

When your state has outstanding federal loans for two consecutive Januarys, your allowable credit is reduced. This reduction is 0.3 percent for the first year and an additional 0.3 percent for each succeeding year until the loan is repaid. A state that has not repaid money it has borrowed from the federal government is called a credit reduction state. Employer rights include confidential handling of your information and protection from unauthorized disclosure. Many documents you receive give you the option to appeal the decision or assessment.

- The Employee Detail Report, Form 132, requires employers to report the number of hours worked during a quarter.

- If you have employees in Alaska, New Jersey, or Pennsylvania you will also be withholding unemployment taxes from your employees’ wages because these three states assess unemployment taxes on employees.

- In that circumstance, the LLC must pay UC taxes for its members under the “catch-all clause” in Section 4 of the UC Law.

- Each return covers the activity during the calendar quarter.

- Payments by the employer to or on behalf of an employer for sickness or accident disability after the expiration of six calendar months.

- When a business who possesses a 501C IRS exemption employs 4 or more workers in some portion of a day in each of 20 different calendar weeks in a calendar year.

If there is no common ownership, management or control with the predecessor employer, no experience rating is transferred and the new business entity is assigned the new account rate. When you acquire an entire Arizona business or substantially all of the assets thereof, and continue to operate it for purposes of liability, you are a successor to a predecessor’s business. As a successor, you are assigned the tax rate and experience rating account of the former owner, although you will receive a different account number. The experience rating account includes the record of wages and taxes previously paid.

Translation Services

Service performed by an enrolled student of a college, university or school. The total of the experience tax and the social tax can’t exceed 6%. Program parameters come from both federal statute and guidance and state statute and rules. We’re working to restore all services as soon as possible. If a discrepancy is found, the IRS will notify the employer by letter.

ESD assesses the solvency tax for the following calendar year. If an employer finds that an error was made in a quarterly report after the report has been filed, an adjustment can be made online or on the Adjustment to Employer Quarterly Report (Form NCUI-685). WithMyTax Illinoisyou can file your monthly or quarterly wage report using this secure online application. For UI purposes, the Maryland State Directory of New Hires is used to protect against UI overpayments and fraud.